Canada Housing Benefit

Student aid and education planning. Plan for an education save budget.

New Housing Subsidy Will Offer Rent Relief To Households Making Less Than Six Figures Yukon News

This program provides a direct monthly benefit payment to eligible households to help pay their rent.

:format(webp)/cloudfront-us-east-1.images.arcpublishing.com/tgam/BVATS3EULFE3TCJDD5ZFAWZXIQ.jpg)

. Eviction bans and suspensions to support renters. New benefit for renters. The Canada Housing Benefit is a benefit that was introduced to Canada and is administered through the provinces to help lower-income Canadians better afford rent.

For additional financial support such as Employment Insurance child benefit pensions and benefits for housing education training family people with disabilities and after a death visit the Benefits page. The Canada Workers Benefit will help Canadians who work but still struggle. Find out why 250000 people in Canada call housing co-ops home.

Workers including the self-employed who are quarantined or sick with COVID-19 but do not qualify for EI sickness benefits. Look at housing options expected costs and your personal financial situation. The government has announced new proposed financial support to help low-income renters with their housing costs.

Learn more about Canadas actions to help people businesses and organizations facing hardship as a result of the COVID-19 outbreak. If you have a balance owing the CRA may keep all or a portion of any tax refunds or GSTHST credits until the amount is repaid. Portable which means you may receive the benefits even when you move to another address.

The Competition Bureau is an independent law enforcement agency that protects and promotes competition for the benefit of Canadian consumers and businesses. One-Time Top-Up to the Canada Housing Benefit. 1 2022 who received dental care between Oct.

The first benefit period is for children under 12 years old as of Dec. If you are receiving EI benefits repayment of your CERB debt from Service Canada will be recovered automatically at 50 of your EI benefit. A house is the most expensive thing most of us will ever buy and thats reflected in housings outsized influence on the US.

The new one-time top-up to the Canada Housing Benefit aims to help low-income renters with their housing costs. Housing rebate financial assistance for home repairs improve accessibility for disabled occupants increase energy-efficiency. Eviction bans and suspensions to support renters.

The Canada Housing Benefit was co-developed with provinces and territories and launched in 2020 with joint funding of 4 billion over eight years to provide direct financial support to Canadians who are experiencing housing need. ReMax Canadas 2023 housing outlook shows cities such as Calgary and Halifax are set to see price growth while major Ontario and BC. Board of directors and committees.

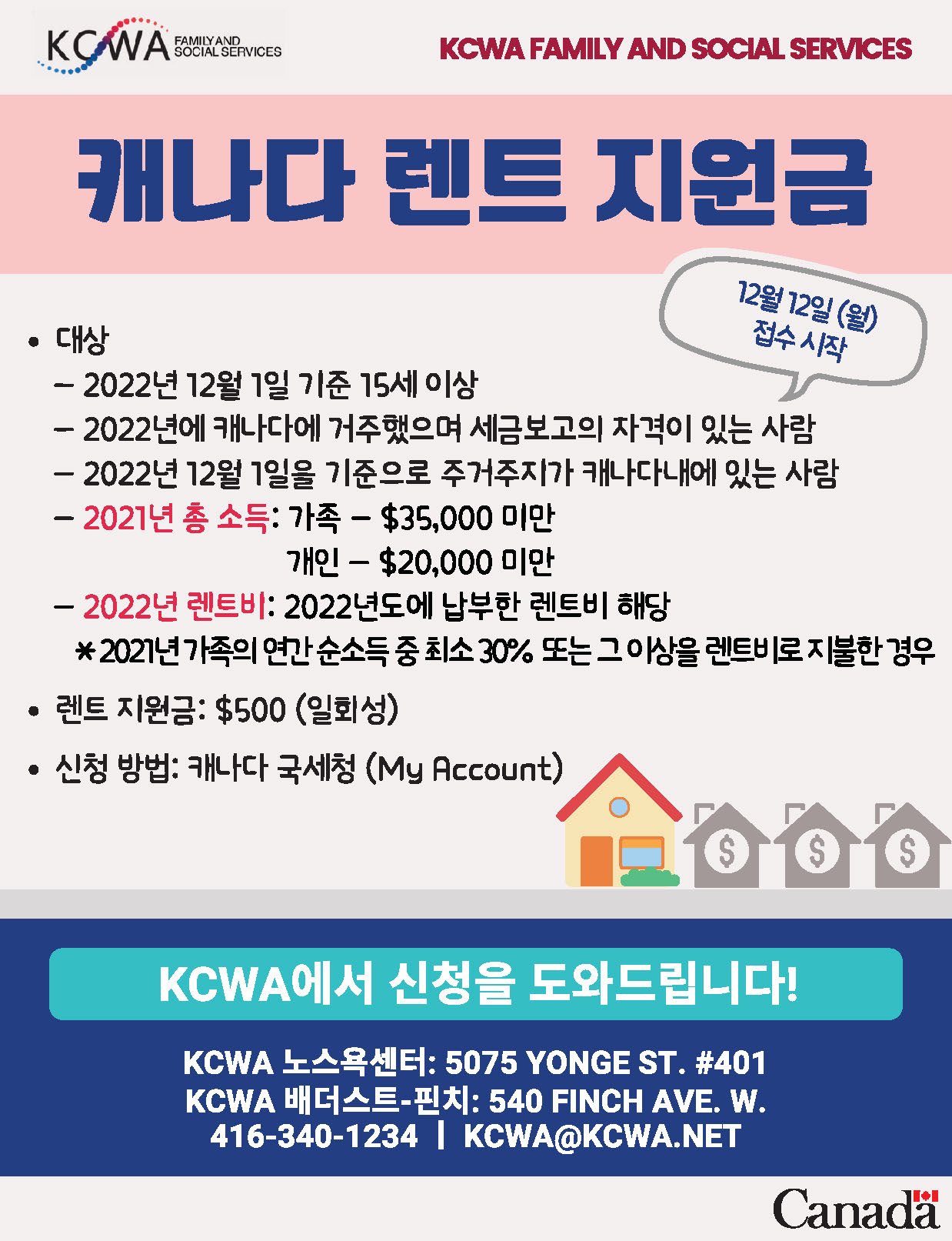

Globe Investor offers the most current and up-to-date information on stocks and markets from The Globe and Mail. Moreover the Canada Housing Benefit even got a recent top-up by the federal government that is being administered by the Canada Revenue Agency a unique exception to how things typically run. With this top-up low-income families where households earn less than 35000 and individuals earn less than 20000 might be eligible for a one-off.

Proposed new benefit for renters announced. 1 2022 and June 30 2023. The benefit payments are.

Explore homebuyer and rental guides use mortgage calculators renovation and maintenance tips. Explore student aid and career options. Each province has its own system for accessing the money but per the Prime Ministers Office families who qualify for the federal benefit must have an income of less than 35000.

Based on the household income and local market rent. Transparency Accessibility Plan. In addition the government indicated you should book a dental.

Eviction bans and suspensions to support renters. That is as much as 1100 to handle unexpected costs and help plan for the future. The benefit is tied to the household and can be used to help pay rent anywhere in Ontario.

Markets are due for declines. To get ready for the proposed measures make sure to file your 2021 taxes and check that you have access to your CRA My Account. Housing contributes an estimated 15 to the US.

One-Time Top-Up to the Canada Housing Benefit. This provincially administered benefit is available to eligible priority groups who are on. The Canada Revenue Agency CRA administers this one-time payment.

Competition Bureau Canada News. Knowledge and expertise to help make affordable housing a reality. The one-time top-up to the Canada Housing Benefit aims to help low-income renters with the cost of renting.

All CERB from Service Canada debts must be repaid to ESDC. You may be eligible for a tax-free one-time payment of 500 if your income and the amount that you pay on rent qualify. You may be eligible to apply if your income and the amount that you pay on rent qualify.

1 2022 and June 30 2023. Find personal finance mortgage investment ideas market information and stock. Canada Pension Plan Old Age Security Guaranteed Income Supplement Retirement planning.

Competition Bureau to study competition in Canadas grocery sector. To receive benefit payments you must have filed a 2021 tax return and must currently be receiving the Canada Child Benefit. The Canadian housing bubble has popped with prices down 14 per cent from the peak reached in the first quarter of the year.

To apply for this new federal one-time payment you. One-Time Top-Up to the Canada Housing Benefit. The Canada Ontario Housing Benefit COHB program provides households with a portable housing benefit to assist with rental costs in the private housing market.

One-time top-up to the Canada Housing Benefit. This flat-payment Benefit would be administered through the Canada Revenue Agency CRA and provide income support to. Because of the Canada Workers Benefit a lower-income worker earning 15000 a year could receive up to nearly 500 more from the program in 2019 than they received in 2018.

This forward-looking community engaged politicians ministers and other decision-makers to the benefit of thousands of housing co-op members across the country. The first benefit period is for children under 12 years old as of Dec. Looking at home affordability the ratio of mortgage payments to income we estimate it will take another 25 per cent drop in home prices for affordability to return to its historic average.

Key roles and responsibilities. Get ready to apply before the applications open on December 12 2022. The proposed one-time top-up to the Canada Housing Benefit program would consist of a tax-free payment of 500 to provide direct support to low-income rentersthose most exposed to inflationwho are experiencing housing affordability challenges.

To receive benefit payments you must have filed a 2021 tax return and must currently be receiving the Canada Child Benefit. 1 2022 who received dental care between Oct. Transparency Accessibility Plan Accessibility Feedback Canada Mortgage and Housing Corporation CMHC 2022.

Competition drives lower prices and innovation while fueling economic growth. Introducing the Emergency Care Benefit providing up to 900 bi-weekly for up to 15 weeks. Such as the Canada Workers Benefit the Canada Child Benefit the Goods and Services Tax.

In addition the government indicated you should book a dental.

Canada Housing Benefit Will Give 3k A Year To Low Income Ontario Tenants R Ontario

Ynsbbrwcahkdpm

Strings Attached The National Housing Strategy Won T Help People Struggling With Homelessness Now Pivot Legal Society

Projects Blog Town Of Mahone Bay

Pziwtr4glcw9am

The Canada New Brunswick Housing Benefit New Brunswick Association For Community Living Nbacl

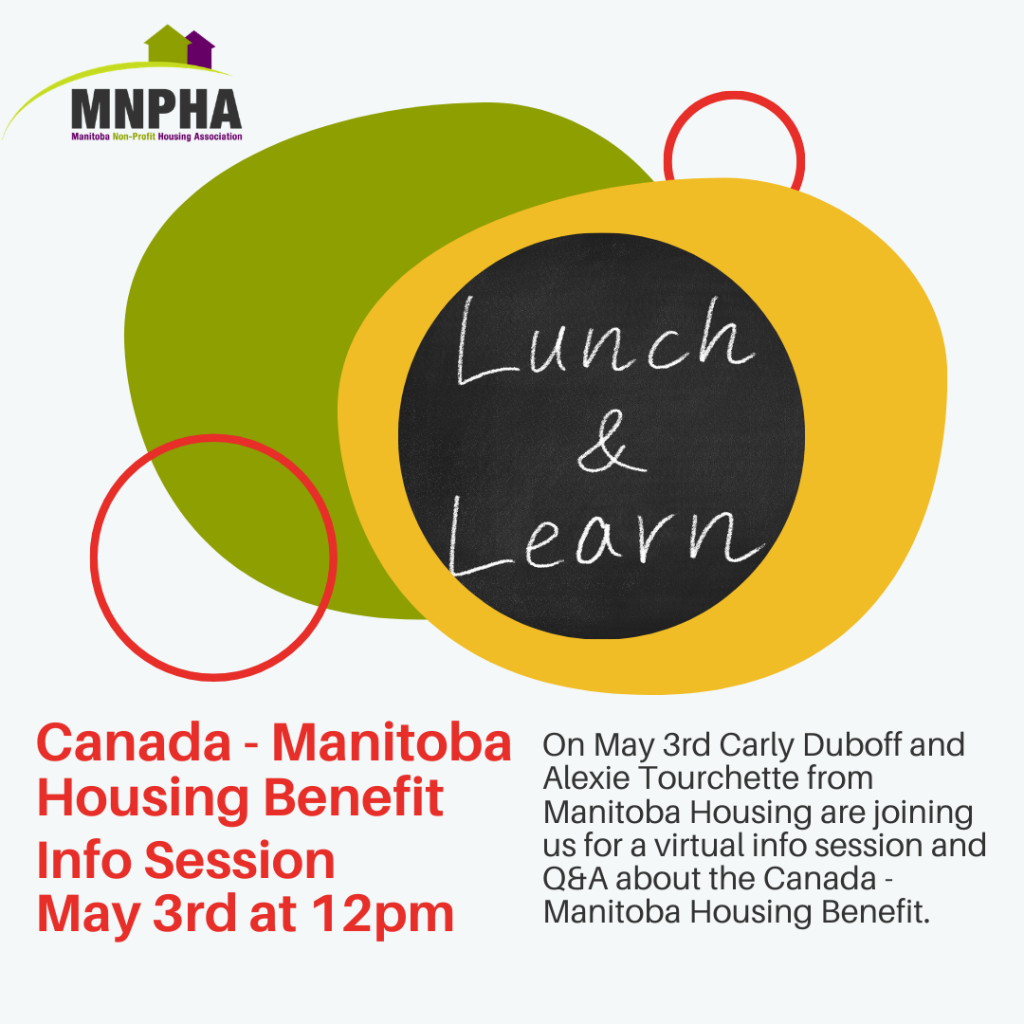

Past Events Mnpha Manitoba Non Profit Housing Association

New Housing Benefit Streams To Support People In Saskatchewan In Housing Need

New Canada Housing Benefit Will Help Some Of The Poorest Maybe Pp G Review

Ecjqux0u2qs Xm

Federal And Provincial Governments Sign New Housing Benefit Citynews Halifax

:format(webp)/cloudfront-us-east-1.images.arcpublishing.com/tgam/BVATS3EULFE3TCJDD5ZFAWZXIQ.jpg)

Low Income Renters In Canada Can Apply For A One Time Payment Of 500 On Monday Here S What You Need To Know The Globe And Mail

Finance Canada On Twitter 3 3 Bill C 31 Also Implements A One Time Top Up To The Canada Housing Benefit Which Will Provide A Tax Free Payment Of 500 Directly To Eligible Low Income Renters Applications For

Gdocahcbn5 Npm

Wgfugfzto6pafm

How To Apply For The Canada Housing Benefit Top Up Ctv News

Here S How You Can Get An Extra 500 From The Canada Housing Benefit Urbanized